William H. Black, Jr. discusses the financial advantages of having a good plan in place

Your practice is established. You have a good reputation and a good management team in place. Gone are the days of building the practice and putting all profit back toward growth. That’s the good part! But success creates other questions and concerns.

When clients first come to us they typically have the same refrain: “I am paying salaries, sick pay, vacation pay, major medical, matching Social Security and Medicare, paying into unemployment and Workman’s Comp. I have to pay a lot of money in income taxes…How do I keep more of what I make? No one has any solutions for me!”

What I’ve found clients really mean is they want an idea that is not “outside the box,” that won’t increase their audit profile, an idea that won’t get them in trouble with Internal Revenue. The simple answer is to consider a custom-designed qualified plan! In other words, consider a form of a pension plan (known as “qualified” because the contribution qualifies for an income tax deduction).

Think about it this way: there is not a company on the New York Stock Exchange, a union, or government agency that doesn’t have a pension plan. So using the rules that are on the books to create a custom-designed plan for the closely held professional practice may be the answer.

Consider the benefits:

- Contributions are income tax deductible

- Plan assets grow tax deferred

- Plan assets are protected from judgment creditor claims1

- Plan assets are eligible for tax-free rollover to one’s IRA account

- Qualified plans receive up-front approval from Internal Revenue in the form of a Favorable Determination Letter

Let me clear up a few myths straightaway. These plans are not about retirement; they are about the tax benefits and asset accumulation features, i.e., your money tree. Who’s worried about retirement? It’s the employees putting $25 a week into their 401(k) plan. More power to those employees, but we, as business owners, are past that. Look at a plan as a way to pay yourself on a tax-favored basis!

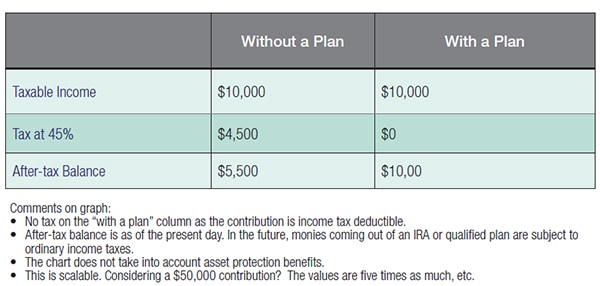

Here is how to look at the merits. Assume a 39% federal income tax rate and assume a 6% state income tax rate. So, for brevity, we will assume an overall tax rate of 45%. Since there is no requirement to have a plan, what does it look like without one? For every $10,000 in taxable income, what does it look like with a plan or without one? (We use $10,000 in this analysis because it is scalable. Want to know what $50,000 would do? Multiply by 5. $75,000? Multiply by 7.5, etc.)

Here is where it gets interesting. On one hand you have $10,000 working for you; on the other, you have $5,500. The tax benefits alone give you 81% more (10,000 ÷ 5,500) right out of the gate. Now, consider the plan’s assets grow tax deferred while the non-plan grows taxably. Add it all together, and you can see the benefits growing with every passing year!

Many believe, initially, that the plan will cause all employees to come in, with contributions for all, and any employee is entitled to take his/her contribution out immediately. While plans like that do exist, they are not well designed or well thought out.

ERISA, the Employee Retirement Income Security Act of 1974, gives us 39 years of instruction on how to design a plan. In other words, these plans are black and white, really no gray area.

Now the question becomes how to design a plan to benefit the rainmaker? That is the easy part!

When clients first come to us they typically have the same refrain: “I am paying salaries, sick pay, vacation pay, major medical, matching Social Security and Medicare, paying into unemployment and Workman’s Comp. I have to pay a lot of money in income taxes…How do I keep more of what I make?

Many different options exist, hence the need for customization. Many “cookie cutter” plans are out there, a one-size-fits-all approach. These are commonly referred to as “bundled” plans. While those plan designs have their place, they cannot be all things to all people. What to do? Start with a checklist of basic questions. What is the annual budget for the contribution? How is the business set up, as a Corporation either S or C, as an LLC, LLP, PA, Partnership, or Sole Proprietor? How many employees? Are there existing plans in place now? How is the ownership structured, all in the hands of one person, or two or more?

With the above, and an employee census, i.e., employee names, dates of birth and dates of hire, job titles and annual salaries, a projection can be created that will show, in black and white, what the benefits and detriments are. Look at it in conjunction with your CPA and make a business decision on what is right for your situation.

This discussion is not intended as tax advice. The determination of how the tax laws affect a taxpayer is dependent on the taxpayer’s particular situation. A taxpayer may be affected by exceptions to the general rules and by other laws not discussed here. Taxpayers are encouraged to seek help from a competent tax professional for advice about the proper application of the laws to their situation.

- Patterson v. Schumate (https://financial-dictionary.thefreedictionary.com/Patterson+v.+Shumate)

Stay Relevant With Implant Practice US

Join our email list for CE courses and webinars, articles and mores

William H. Black, Jr. has been in the pension administration business for 34 years. The firm Pension Services, Inc. administers both defined contribution and defined benefit plans, employs an ERISA attorney, an Enrolled Actuary, and complete clerical staff. Mr. Black is qualified to give continuing education to CPAs in 47 different states. He has spoken nationally and internationally on retirement plans, has been quoted in USA Today, written articles for several industry journals and has appeared on many financial radio shows discussing the topic of retirement and financial matters. He may be contacted at

William H. Black, Jr. has been in the pension administration business for 34 years. The firm Pension Services, Inc. administers both defined contribution and defined benefit plans, employs an ERISA attorney, an Enrolled Actuary, and complete clerical staff. Mr. Black is qualified to give continuing education to CPAs in 47 different states. He has spoken nationally and internationally on retirement plans, has been quoted in USA Today, written articles for several industry journals and has appeared on many financial radio shows discussing the topic of retirement and financial matters. He may be contacted at